Each exchange has a different procedure for both setup and transaction, and should give you sufficient detail to be able to execute the purchase. Combined with SegWit, this could allow a much greater number of transactions, without changing the block size limit And work is proceeding on the lightning network , a second layer protocol that runs on top of bitcoin, opening up channels of fast microtransactions that only settle on the bitcoin network when the channel participants are ready. If you wish recommended , you can then move the funds to your off-exchange wallet.

Top Stories

The cryptocurrency one of many is at the center of a complex intersection of privacy, banking regulations, and technological innovation. Today, some retailers accept bitcoin, while in other jurisdictions, bitcoin is illegal. Cryptocurrencies are lines of computer code that hold monetary value. These lines of code are created by electricity and high-performance computers. Cryptocurrency is also known as digital currency.

Get the Latest from CoinDesk

The financial world can’t stop talking about bitcoin. In recent weeks, the headlines of business journals and finance sections have covered everything from the importance of investing in bitcoin to how the bubble is about to burst within days of bitcoin futures hitting the stock exchange. To anyone on the outside, those words make no sense. Introduced in , bitcoin is an anonymous cryptocurrency, or a form of currency that exists digitally through encryption. It was invented to be unhackable, untraceable, and safe for investors.

The cryptocurrency one of many is at the center of a complex intersection of privacy, banking bitckin, and technological innovation. Today, some retailers accept bitcoin, while in other jurisdictions, bitcoin is illegal. Cryptocurrencies are lines of computer code that hold monetary value. These lines of code are created by electricity and high-performance computers.

Cryptocurrency is also known as digital currency. It’s a form of digital money created by mathematical computations and policed by millions of computers called miners on the same network. Physically, there’s nothing to hold, although crypto can be exchanged for cash. Crypto comes from the word cryptographywhich is the process used to protect the transactions that send the lines of code for purchases.

Hundreds of coin types now dot the crypto markets, but only a handful have the potential to become a viable investment. Governments have no control over the creation of cryptocurrencies, which is what initially made them so popular. Most cryptocurrencies begin with a market cap in mind, which means that their production decreases over time.

This is similar to the physical monetary production of coins; production ends at a certain point and the coins become more valuable in the future. No one knows who created it — most cryptocurrencies are designed for maximum anonymity — but bitcoins first appeared in from a developer reportedly named Satoshi Nakamoto.

He has since disappeared and left behind a bitcoin fortune. Because bitcoin was the first major cryptocurrency, all digital currencies created since then are called altcoins, or alternative coins.

LitecoinPeercoinFeathercoinEthereumand hundreds of other coins are all altcoins because they are not bitcoin. One of the advantages of bitcoin is that it can be stored offline on local hardware, such as a secure hard drive.

This process is called cold storage, and it protects the currency from being stolen by. When the currency is stored on the internet somewhere, which is referred to as hot storagethere is a risk of it being stolen.

On the flip side, if a person loses access to the hardware that contains the bitcoins, the currency is gone forever. From tocriminal traders made bitcoins famous by buying them in batches of millions of dollars so thfough could move money outside of the eyes of law enforcement and tax collectors. Subsequently, the value of bitcoins skyrocketed. Scamstoo, are very real in the cryptocurrency world. Naive and savvy investors alike can lose hundreds or thousands of dollars to scams.

Bitcoins and altcoins are controversial because they take the power of issuing money away from central banks and give it to the general public.

Bitcoin accounts cannot be frozen or examined by tax inspectors, and middleman banks are unnecessary for bitcoins to. Law enforcement how does buying through bitcoin work and bankers see bitcoins as similar to gold throkgh in the wild west — beyond the control of police and financial institutions.

Once bitcoins are owned by a person, they behave like physical gold coins. They possess value and trade just as if they were nuggets of gold. Bitcoins can be used to purchase goods and services online with businesses that accept them or can be tucked away in the hope that their value increases over time. Bitcoins are traded from one personal wallet to. A wallet is a small personal database that is stored on a computer drive, smartphonetablet, or in the cloud.

Bitcoins are forgery-resistant because multiple computers, called nodes, on the network must confirm the validity of every transaction. It is so computationally intensive to create a bitcoin that it isn’t financially worth it for counterfeiters to manipulate buyint.

A single bitcoin varies in value daily. Check places like Coindesk to see current par rates. Bitcoins will stop being created when the total number reaches 21 billion coins, which is estimated to be sometime around the year Bymore than half of those bitcoins had been created. The buykng is self-contained and uncollateralized, meaning there’s no precious metal behind the buyinf.

The value of each bitcoin resides within the bitcoin. Bitcoins are stewarded by miners, the network of people who contribute their personal computer resources to the bitcoin network. Miners act as ledger keepers and auditors for all bitcoin transactions.

Miners are paid for their accounting work by earning new bitcoins for the amount of resources they contribute to woro network. Each blockchain is unique to each user and the user’s personal bitcoin wallet. All bitcoin transactions are logged and made available in a public ledger, which ensures their authenticity and prevents fraud. This process prevents transactions from being duplicated and people from copying bitcoins.

While every bitcoin records the digital address of every wallet it touches, the bitcoin system does not record the names of the people who own wallets. Hos practical terms, this means dows every bitcoin transaction is digitally confirmed but is completely anonymous at the same time. So, although people cannot easily see the personal identity or the details of the transaction, they can see the verified financial history of a buyingg wallet.

This is a good thing, as a public history adds transparency and security to every transaction. Bbitcoin mining involves commanding a home computer to work around the clock to solve proof-of-work problems computationally intensive math problems.

Each bitcoin math problem has a set of possible digit solutions. A desktop computer, if it works nonstop, might be able to solve one bitcoin problem in two to three days, however, it might take longer. A single personal computer that mines bitcoins may earn 50 cents to 75 cents per day, minus electricity costs. Bitcoin mining is profitable only for those who run multiple computers with high-performance video processing cards and who join a group of miners to combine hardware power. This prohibitive hardware requirement is one of the biggest security measures that deter people from trying to manipulate the bitcoin.

People who take reasonable precautions are safe from having their personal bitcoin caches stolen by hackers. More than hacker intrusion, the real loss risk with bitcoin revolves around not backing up a wallet with a fail-safe copy.

There is an important. The public collapse of the Mt. Gox bitcoin exchange service was not due to any weakness in the bitcoin. Rather, the organization collapsed because of mismanagement and the company’s unwillingness to invest in appropriate security measures.

Gox had a large bank with no security guards. Bitcoins can be double-spent in some rare instances during the confirmation interval. Because bitcoins travel peer-to-peer, it takes several seconds for a transaction to be confirmed across the P2P computers.

During throgh few seconds, a dishonest person who employs fast clicking can submit a second payment of the same bitcoins to how does buying through bitcoin work different recipient. Because bitcoin mining is best achieved through pooling joining a group of thousands of other minersthe organizers of each pool choose how to divide bitcoins that are discovered. With Mt. Gox as the biggest buyin, the deos running unregulated online exchanges that trade cash for bitcoins can be dishonest or incompetent.

The only difference is that conventional banking losses are partially insured for the bank users, while bitcoin exchanges have no insurance coverage for users. This may change, as unregulated money is a threat to government control, taxation, and policing. Bitcoins have become a tool for contraband trade and money laundering because of the lack of government oversight.

The value of bitcoins skyrocketed in the past because wealthy criminals purchased bitcoins in large volumes. Because there is no regulation, people can lose out as a miner or investor. Bitcoins are transferred through a peer-to-peer network between individuals, with no middleman bank to take a slice. Bitcoin wallets cannot be seized or frozen or audited by banks and law enforcement. Bitcoin wallets cannot have spending and withdrawal limits imposed on. Nobody but the owner of the bitcoin foes decides how the wealth is managed.

Conventional payment methods such as a credit card charge, bank draft, personal check, or wire transfer benefit from being insured and reversible by the banks involved. In the case of bitcoins, every time bitcoins change hands and change wallets, the result is final.

Simultaneously, there is no insurance protection for a bitcoin wallet. If a wallet’s hard drive data or the wallet password is lost, the wallet’s contents are gone forever. Share Pin Email. What Are Bitcoins? Bitcoin Cash Litecoin Peercoin Feathercoin. Paul Gil. Paul Gil, a former Lifewire writer who is also known for his dynamic internet and database courses and has been active in technology fields for over two decades.

Updated November 14, Various events turned bitcoin into a media sensation. Servers nodes that support the network of miners Online exchanges that convert bitcoins into dollars Mining pools. There are two main security vulnerabilities when it comes to bitcoin:. A stolen or hacked password of the online cloud bitcoin account such as Coinbase The loss, theft, or destruction of the hard drive where the bitcoins are stored.

There are three known ways that bitcoin currency can be abused:. There is a lot of controversy around bitcoins. Continue Reading. Investing or Using Bitcoins? Watch for Scams and Protect Yourself.

How to buy Bitcoin for Beginners

Accessibility links

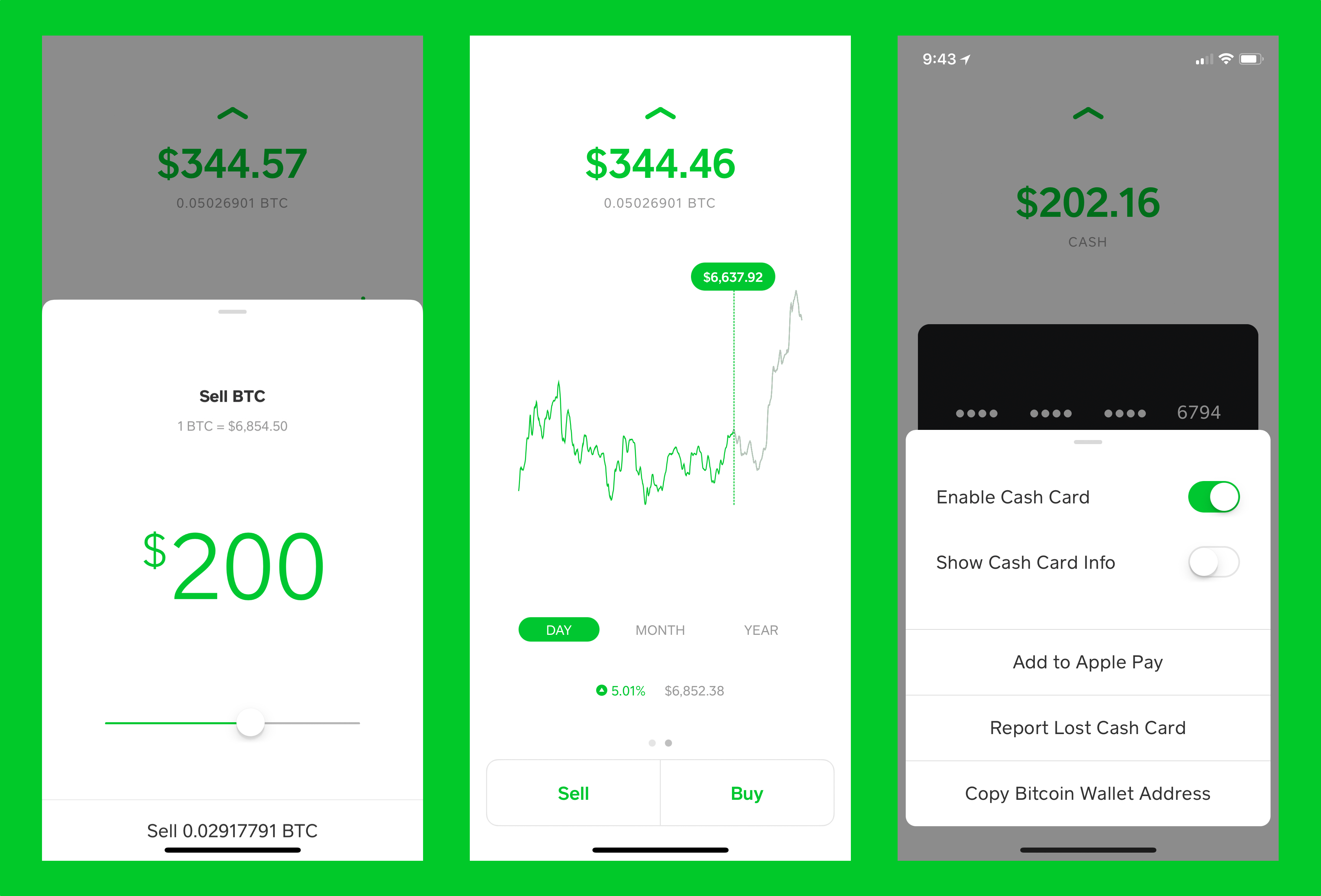

As a reward for its work, the victorious miner gets some new bitcoin. Each exchange has a different interface, and some offer related services such as secure storage. This makes bitcoin more attractive as an asset — in theory, if demand grows and the supply remains the same, the value will increase. Before settling down with an exchange, date. Exodus can track multiple assets with a sophisticated user interface. Holders of the currency and especially citizens with little alternative bear the cost. And because there are no miners that need incentivizing, transaction fees are low or even non-existent. While an exchange like Coinbase remains one of the most popular ways of purchasing bitcoin, it is not the only method. With services such as WalletGeneratoryou can easily create a new address and print the wallet on your printer. And so on. Cold Storage Definition With cold storage, the digital wallet is stored in a platform that is not how does buying through bitcoin work to the internet. Best for Branching Out: Binance. The repercussions could be huge. If a computer is the first to solve a hash, they store newly-made transactions as a block on the blockchain, at which point they become unalterable. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The public key is the location where transactions are deposited to and withdrawn .

Comments

Post a Comment