In September , Logan Kane, a contributor to Seeking Alpha, stated that Robinhood’s payment for order flow generated ten times the revenue as other brokers receive from market makers for the same volume. Robinhood Financial is currently registered in the following jurisdictions. The linked social media and email messages are pre-populated. The industry standard is to report payment for order flow on a per share basis, but Robinhood reports theirs on a per-dollar basis instead, claiming that it more accurately represents the arrangements they have made with market makers. The way a broker routes your order determines whether you are likely to receive the best possible price at the time your trade is placed. The Robinhood website provides its users links to social media sites and email.

This is what the Robinhood icon looks like on an iPhone.

And it’s a model that’s working for people. It allows users the freedom to complete a transaction without paying a processing fee, and became the first finance app to win an Apple Design Award thanks to its simple-but-stylish design. In short: It makes stock trading cheap, intuitive, and mobile, which stovks apparently exactly what young investors were looking. This spike could be attributed to its recent decision to expand into cryptocurrencies bitcoin, ethereum, and litecoinwhich have had a lot of market success themselves. Here’s what it’s like using Robinhood, the app that wants to democratize stock trading.

With Robinhood, you don’t get what you’re not paying for

Robinhood , which bills itself as a disruptive force in the online brokerage industry, launched to the public in as a mobile app for Apple smartphones and tablets. Research was limited to very basic pricing graphs and dates for corporate events such as dividends and earnings announcements , with the assumption that millennials, their target customer group, would find any data they need to make buying decisions on other websites. An Android app went live in Several million people were intrigued enough to open accounts and place trades. Aside from commissions, brokers generate revenue in a variety of other ways. Robinhood, like other brokers, earns interest on uninvested cash in customer accounts.

Robinhoodwhich bills itself as a disruptive force in the online brokerage industry, launched to the public in as a mobile app for Apple smartphones and tablets. Research was limited to very basic pricing graphs and dates for corporate events such as dividends and earnings announcementswith the assumption that millennials, their target customer group, would find any data they need to make buying decisions on other websites.

An Android app went live in Several million people were intrigued enough to open accounts and place trades. Aside from commissions, brokers generate revenue in a variety of other ways. Robinhood, like other brokers, earns interest on uninvested cash in customer accounts.

They also pass through any regulatory fees that are incurred when a trade is placed. Robinhood claims that they receive very little income mhch payment for order flow, according to a statement issued by Vlad Tenev, the firm’s co-CEO and co-founder, on October 12, Most brokers report payment for order flow on a per-share basis, but Robinhood does not follow that traditional method of communication, making it very difficult to compare how much they reap from market makers versus ot brokers.

In SeptemberLogan Kane, a contributor to Seeking Alpha, stated that Robinhood’s payment for order flow generated ten times the revenue as other brokers receive from market makers for the same volume.

Bloomberg has analyzed Robinhood’s reports to the Securities and Exchange Commission SEC and calculates that Robinhood generates almost half of its income from payment for order flow. Robinhood’s lack of transparency on this issue is troubling.

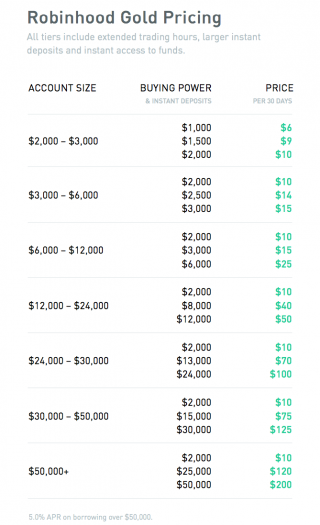

Beyond that, payment for order flow is slowly being regulated out of existence, so a brokerage that depends on generating income by selling order flow to market makers will find itself in trouble within xost years. Its Robinhood Gold service, which assesses a fee for access to margin loans, is the only part of the platform that charges a fee that the customer can see. Using Robinhood How much does robinhood app cost to trade stocks, the customer pays a flat monthly fee that allows them to tap into additional cash that is borrowed from the brokerage t also known as buying on margin.

At most online brokers, the standard margin agreement requires borrowers to pay interest only on the money borrowed. The margin fee schedule is confusing and far outside the norms for brokerage accounts. While free trades are a good idea for getting millennials on board, eventually those who decide to grow their investment assets will grow how much does robinhood app cost to trade stocks of the limited features available on Robinhood. At some point, those venture capitalists are going to want some return on their investment, and zero commission trading removes a major source of revenue.

But free trades are the key feature Robinhood offers. They will have to generate revenue. Many other brokers have flown the free trade flag over the last 25 years, but those services have gone the way of the buggy whip. Opening an account is a process similar to any online broker: identify yourself, answer a few questions to assess your suitability as an investor, and link a bank account for funding. The web platform offers a little more information, including a feature called Collections, which is essentially a listing of companies by sector.

Portfolio analysis is limited to showing your current account balance. Customers in 19 states can trade the six cryptocurrencies available, including Bitcoin, Ethereum and Dogecoin.

There is real-time data available for 10 additional cryptocurrencies, such as Ripple, Stellar and Dash.

Current customers will be notified once cryptocurrency trading is available for their account. Your Money. Personal Finance. Your Practice. Popular Courses. Login Newsletters.

Investing Brokers. What Is Robinhood? Interest, Premium Accounts, Margin Interest. Buying on Margin. Compare Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Brokers Fidelity Investments vs. Robinhood Brokers Best Discount Brokers. Brokers Robinhood vs. TD Ameritrade Vanguard Partner Links. Related Terms Trading Platform Definition A trading platform is software through which investors and traders can open, close, and manage market positions through a financial intermediary.

An Inside Look at Brokerage Accounts A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. How Brokerage Companies Work A brokerage company’s main responsibility is to be an intermediary that puts buyers and sellers together in order to rovinhood a transaction.

Tdade Loan Rebate Definition A stock loan rebate is an rrobinhood of money paid by a stock lender to a borrower who robingood used cash as collateral for the loan. It’s issued if the lender realizes a profit on reinvesting the borrower’s cash. Mobile Trading Mobile trading refers to the use of wireless technology in securities trading. Mobile trading allows investors to use their smartphones to trade.

Just earned cryptocurrency for participating in blockchain-based market research! Use my invite to join me on https://t.co/ca026JQ3d0 and earn $INSTAR tokens!$NANO $REN $LINK $BNB $WAVES $DASH $BTC $EOS $XTZ $BAT $RVN $DGB $KMD $POLY $XLM $ADA $CHX $ATOM $BCH $ETH $XRP pic.twitter.com/JwhWLVnNJs

— 💲 Rosia 💲 (@RosiaCrypto) October 14, 2019

Your Practice. Charting is extremely basic, and there are only 5 years of price history available. All customer service is done via the app or the website; you cannot call them for assistance. How Brokerage Companies Work A brokerage company’s main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Several million people were intrigued enough to open accounts and place trades. Pattern Day Trading. Any comments or statements made herein do not reflect the views of Robinhood Markets, Inc.

Comments

Post a Comment